5 Reasons to Use Sedl for Money Transfers in 2025

In today’s fast-paced digital world, sending money abroad shouldn’t feel like a gamble. Yet, many people still face delayed transactions, hidden fees, and poor exchange rates. Whether you’re supporting family overseas, paying freelancers, or managing a remote team, speed, transparency, and control are non-negotiables.

That’s where Sedl steps in — the smarter, faster, and more secure way to send money globally.

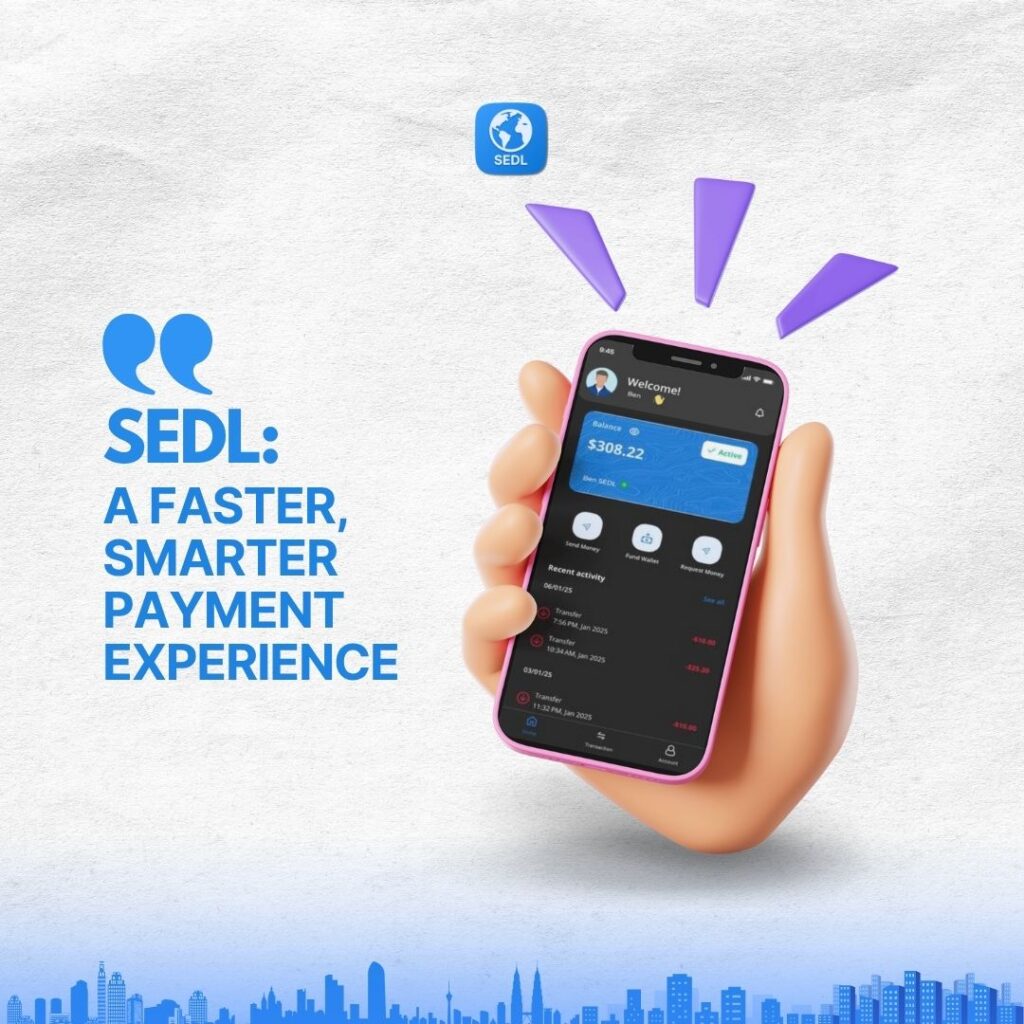

1. Lightning-Fast Transfers

No one wants to wait days for a payment to arrive — especially when it’s urgent. Sedl is built for speed. With real-time processing, you can transfer funds across borders in minutes, not days. In 2025, instant matters more than ever.

2. Ultra-Low Transparent Fees

Tired of “mystery charges”? We are too. Sedl offers a flat, transparent fee structure (1.2%) with no hidden costs. What you see is what you send — and what your recipient gets. No surprises, just clarity.

3. Power in Your Pocket

Sedl isn’t just a money transfer platform. It’s a fully mobile wallet that works anytime, anywhere. Whether you’re on a beach in Lagos or in a London café, your wallet travels with you — fast, functional, and always secure.

4. Built for Global Living

In 2025, the world is more connected than ever. Sedl is designed for digital nomads, freelancers, international families, and global entrepreneurs. Whatever your reason for sending money, Sedl makes it seamless.

5. Total Transparency & Real-Time Tracking

With Sedl, you don’t just send and hope. You track every move, get real-time updates, and know exactly when funds are received. That’s peace of mind, delivered with every transfer.

💡 Final Thought:

Sending money shouldn’t be complicated. It should be safe, simple, and stress-free — and that’s exactly what Sedl delivers. Join thousands who’ve already made the switch to smarter transfers in 2025.

👉 Ready to upgrade how you send money?

Download Sedl and send with confidence today.